2022 Was a Record Year for Central Bank Gold Purchases

Costs and Charts

NZD Gold Up Simply Under 3% Because 21 December

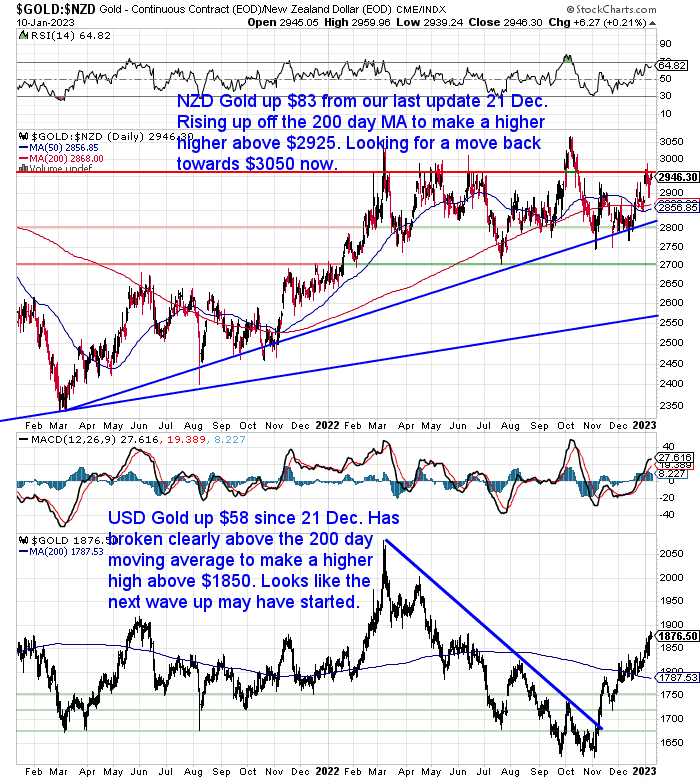

Gold in New Zealand dollars is up $83 considering that our last weekly upgrade on 21 December. It leapt highly off the 200 day moving average (MA) and made a greater high above $2925. We’re now viewing to see if NZD gold can go up towards the 2022 high of $3050.

Gold in United States dollars continued the strong up relocation that has actually remained in play considering that early November. It has actually broken plainly above the 200 day MA and is surrounding US$ 1900 for the very first time considering that April 2022. It appears like the next wave up for USD gold might have begun. However it is close to being overbought so a pullback quickly will not be a surprise.

On The Other Hand NZD Silver Was Down Simply Under 3%

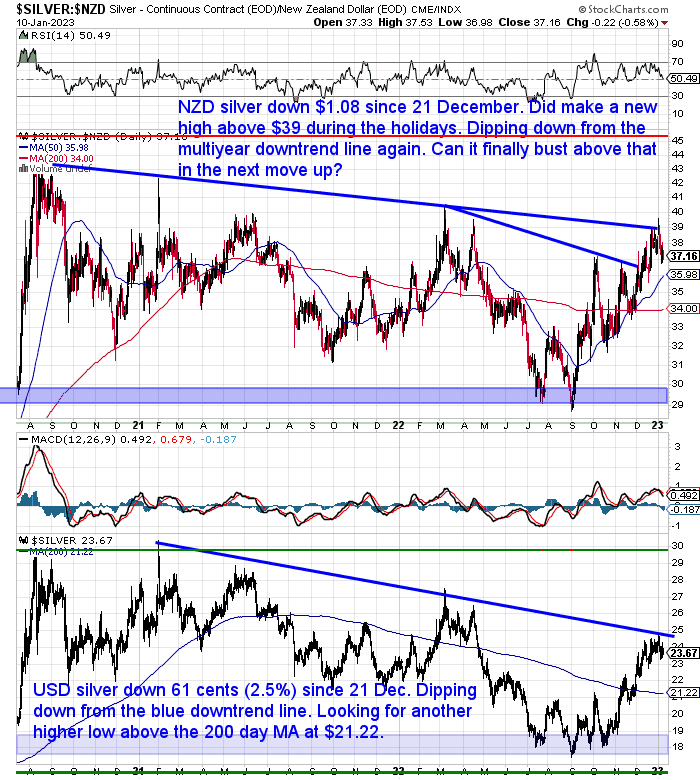

On the other hand silver in NZ dollars was down simply under 3% considering that our last upgrade. Throughout the vacation break it did press greater and return above $39 per oz. However ever since it has actually drawn back after striking the multi year sag line once again. Now silver is back in the low $37’s, however stays above the 50 day MA. That might be a bargain zone to look for once again. As NZD silver has actually held above that moving typical line considering that September.

Very Little Modification in NZ Dollar

Very Little Modification in NZ Dollar

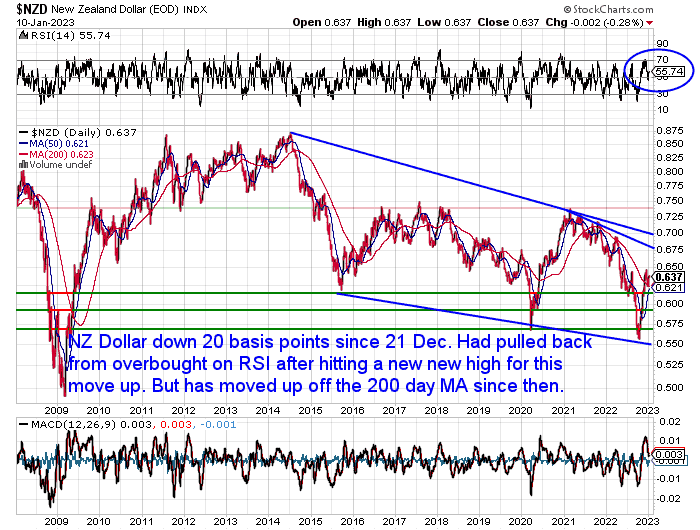

The New Zealand dollar is up simply 20 basis points considering that 21 December. After striking a brand-new high for this go up, the Kiwi had actually drawn back from overbought on the RSI, to now be back in neutral area. It has actually returned up off the 200 day moving average. Might simply silently reinforce once again from here.

Required Assistance Comprehending the Charts?

Have a look at this post if any of the terms we utilize when talking about the gold, silver and NZ Dollar charts are unidentified to you:

Continues listed below

Long Life Emergency Situation Food– Back in Stock

These simple to bring and keep containers indicate you will not need to stress over the racks being bare …

Free Shipping NZ Wide *

Get Comfort For Your Household NOW …

—-

Gold and Silver Costs Held Up Well Over Vacations

Prior To Christmas we reported how the low volume Christmas/New Year break is where we frequently see a spike down in gold and silver rates. This has actually happened in 9 of the last 13 years. However in 2022/2023 rates in fact increased throughout this low volume time.

An even more powerful pattern exists in regards to purchasing completion of one year. Where in 10 of the last 11 years the cost at the end of the next year has actually been greater. We’ll need to wait another year to see if that a person plays out once again.

Goldman Sachs: Whatever the Fed Does Need To be Favorable for Gold

Goldman Sachs trading desk experts have a couple of reasons that gold will likely be greater in a year.

Fed and gold

Couple of ideas from GS trading that are bullish gold:1. If the Fed rotates prematurely and ends up being dovish in a high inflation circumstance, it might be bearish for the United States dollar, which would assist gold

2. If the Fed rotates far too late and triggers a larger economic downturn than is presently priced in, there might be a flight to security, which would likewise assist gold

3. When the rate treking cycle ended in late 2018, gold marked its lows in late October-November of that year and was up 20% in 2019Source.

Your Concerns Desired

Keep In Mind, if you have actually got a particular concern, make sure to send it in to be in the running for a 1oz silver coin.

Economic Crisis Worries and Falling Service Revenues

Another element that is most likely to stay bullish for gold is the arrival of an economic crisis.

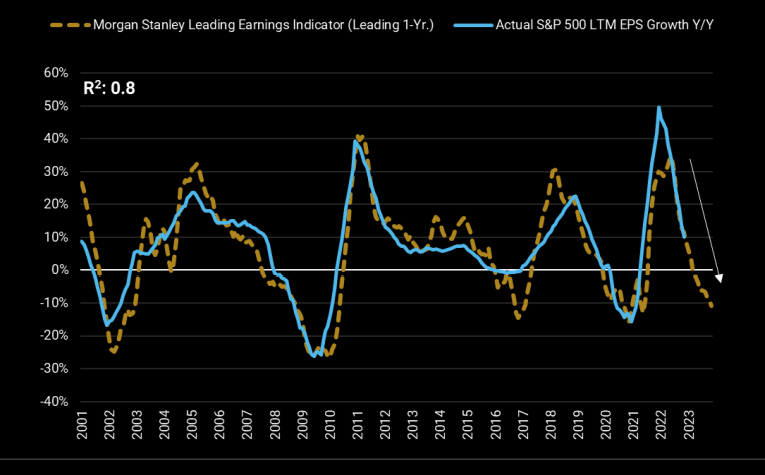

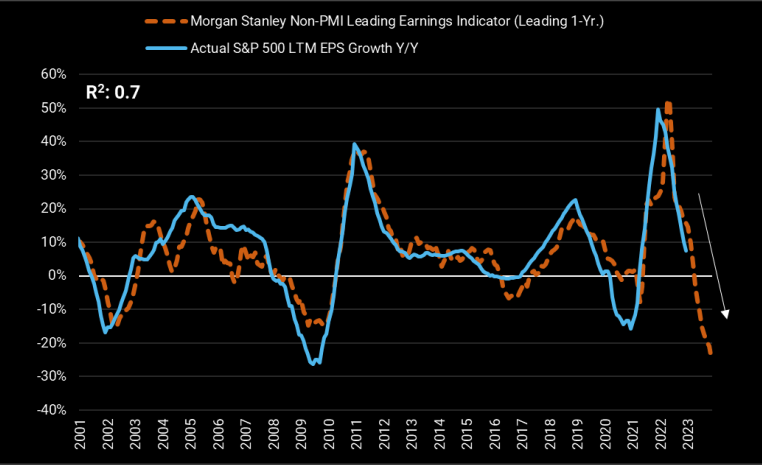

Morgan Stanley’s Chief financial investment officer, Michael Wilson, has actually been most likely the most singing bear among the bank experts in 2022. As The marketplace Ear explains listed below he has actually likewise been extremely precise in his calls in 2015. Today he has actually been making the rounds stating to anticipate another 20% fall in United States stock rates if the United States gets in an economic crisis.

Wilson’s issue

Wilson’s primary issue is that “… a lot of are presuming “everybody is bearish” and, for that reason, the cost drawback in an economic crisis is likewise most likely to be moderate (SPX 3,500-3,600). On this rating, the surprise may be just how much lower stocks might trade (3,000) if an economic crisis shows up”.

The incomes bear

Morgan Stanley’s Wilson has actually been extremely precise in his calls throughout 2022. He states that the marketplace attention is moving from inflation/Fed to incomes and economic downturn next. Leading indications are generally showing huge cuts to incomes.

MS

MS

Source.

2022 Was a Record Year for Reserve Bank Gold Purchases

There has actually been strong need for retail gold throughout the majority of 2022. Although with a sluggish up for the last number of months of the year. Newest numbers reveal that reserve bank need hasn’t slowed at all with China purchasing highly in November and December. 2022 was a record year with over 400 tonnes of gold purchased by reserve banks internationally.

Today’s function post takes a look at these reserve bank numbers with some fascinating charts and after that compares where the RBNZ sits versus other reserve banks in regards to gold reserves.

You’ll find:

- Reserve Banks Purchase Record Amounts of Gold in 2022

- So is the Reserve Bank of New Zealand (RBNZ) Likewise Purchasing Gold?

- How Does New Zealand Compare to the Leading Gold Holding Nations?

- The Leading 100 Gold Holders

- Why the RBNZ is Really Not Likely to Purchase Gold

What are reserve banks getting ready for? They understand what is going on. The sluggish however constant end of the USD as the world’s reserve currency.

Possibly you should be getting ready for and doing the exact same thing?

For a quote on silver or gold:

- Email: [email protected]

- Phone: 0800 888 GOLD (0800 888 465) (or +64 9 2813898)

- or Store Online with a sign prices

— Gotten ready for the unforeseen?–

Never ever stress over safe drinking water for you or your household once again …

The Berkey Gravity Water Filter has actually been attempted and checked in the harshest conditions. Time and once again shown to be efficient in supplying safe drinking water all over the world.

This filter will supply you and your household with over 22,700 litres of safe drinking water. It’s basic, light-weight, simple to utilize, and extremely expense efficient.

Store the Variety …

—-

Source link